Starting an ATM business can be a great way to make money with limited operating costs and no inventory necessary. To get started, try searching for low-cost or free machines online or from banks/credit unions; you may even find businesses that are willing to give away ATMs they don’t need anymore!

Alternatively, loans small business financing options could help cover the cost of purchasing equipment upfront. Last but not least, obtain licensing fees from your local municipality before looking into high-traffic locations where you should promote your services through advertising & social media platforms.

About ATM Businesses

An ATM business is a type of business where you install automatic teller machines (ATMs) and provide cash transaction services to customers. This type of business can be profitable as it provides a service that is in high demand. Moreover, it requires little to no inventory and has low operating costs.

Thinking of starting an ATM business but don’t quite have the capital to do it? Don’t worry – if you look closely, there might be some creative ways for getting around your lack of funds.

Location, equipment and licensing are all essential considerations when launching a venture like this one; research where exactly you’ll set up shop in terms of real estate costs, invest in appropriate machinery that won’t break down right away or cost too much upfront (and check out second-hand options!), and figure out what kind of regulations need complying with at local level. Turns any no money startup plot into reality! But how to start an ATM business with no money?

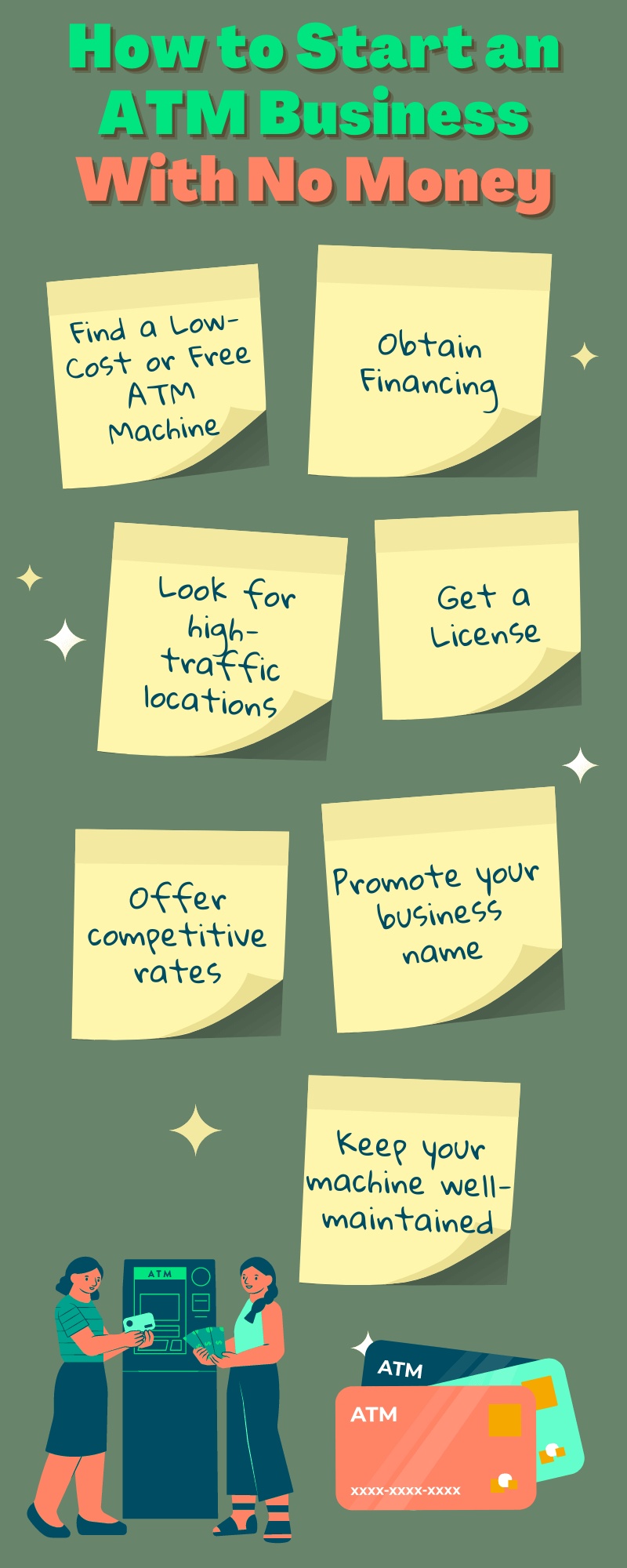

How to Start an ATM Business With No Money?

Starting an ATM business with no money (or little money) is possible, but it will require some creativity and resourcefulness on your part. Here are a few tips to get you started.

Find a Low-Cost or Free ATM Machine

Starting an ATM business doesn’t have to break the bank; you can find budget-friendly machines. From searching online with retailers who specialize in used ATMs, to working out a deal on behalf of your customers – there are multiple ways for entrepreneurs to stay within their means while providing excellent services. There are a few ways to do this:

- Look for used ATM machines online or in your local classifieds. You may be able to find a good deal on an older type of ATM that is still in working condition.

- Contact your local banks and credit unions to see if they have any machines that they are looking to get rid of. Many times, these institutions upgrade their machines and are willing to sell their old ones for a low price.

- Ask around to see if any businesses in your area have ATMs that they no longer use or need. You may be able to buy an ATM machine for a fraction of the cost of a new ATM.

Tip From an ATM Owner

Hi there ATM enthusiast! Starting an ATM business can be a great way to make money with limited out-of-pocket costs. My number one tip for starting an ATM business would be to look into small business financing options such as SBA loans or other financing options if you don’t have enough cash on hand to purchase the equipment upfront. This can help cover your startup costs and give you the financial flexibility to start your business. Good luck!

Obtain Financing

How to start an ATM business with no money? For those without the necessary funds to buy an ATM, financing is available as a resource. Put your money in motion with this convenient solution! There are a few ways to do this:

- Apply for a small business loan from your local bank or credit union. This can be a good option if you have good credit and a solid business plan.

- Use a crowdfunding platform to raise money from friends, family, and strangers. This can be a great option if you have a large network of people who are willing to support your business.

- Find an investor who is willing to provide financing in exchange for equity in your company. This can be a good option if you have a promising business but don’t have the collateral to qualify for a loan.

Get a License

In most cases, you will need to obtain a license from your local municipality in order to operate an ATM business. The cost of this license will vary depending on your location. Contact your local city or county government to find out more information about the licensing process.

Starting Your Own ATM Business: Tips and Tricks

Now that you know how to start an ATM business with no money, here are a few tips and tricks to help you get started in the ATM industry:

- Look for high-traffic locations for your ATM. It’s important to choose a spot that gets a lot of foot traffic and is easily accessible to potential customers. Places such as shopping malls, gas stations, and busy convenience stores are typically good choices for ATM locations.

- Offer competitive rates. In order to attract customers, you’ll need to offer rates that are competitive with other ATM machines in your area. This may require some research on your part.

- Promote your business name. Once you have your machine set up, be sure to promote your business through local advertising and social media.

- Keep your machine clean and well-maintained.

- Make sure that the contact with an ATM operator is easy and effective.

Planning to start your ATM business? Now you know how. Good luck to all the future independent ATM owners!

Frequently Asked Questions

How Much Money Do I Need to Start an ATM Business?

Starting an ATM business may seem a daunting venture, but with the right machines and services in place you can break into this market for between $5,000 and $20,000. Make sure to weigh your options carefully when deciding which ones are best suited to launch your company on its way!

How Much Does It Cost to Run an ATM?

Running an ATM requires careful financial consideration – from the type of machine to the services you provide and how much money you are dispensing. On average, each month will set you back somewhere in between one thousand and three thousand dollars for smooth operation.

How Much Do ATM Owners Make?

With the right number of machines and services, ATM owners are in line for a lucrative career: profits can range from $500 to an impressive $2,500 every month! Investing in ATMs is sure to reap rewards if done correctly.

Are ATMs Worth Owning?

ATMs offer a lucrative opportunity for entrepreneurs: reliable, steady streams of income from customers plus low overhead costs. Whether you’re opening a new business or looking to increase cash flow, ATMs are worth considering as your next venture!

Who Fills Money in ATM Machines?

Financial institutions rely on specialized cash management companies to ensure their ATMs are stocked with the necessary funds. These professionals securely transport and replenish the requirements of each machine, keeping transactions smooth and reliable for everyone involved.