Key Points

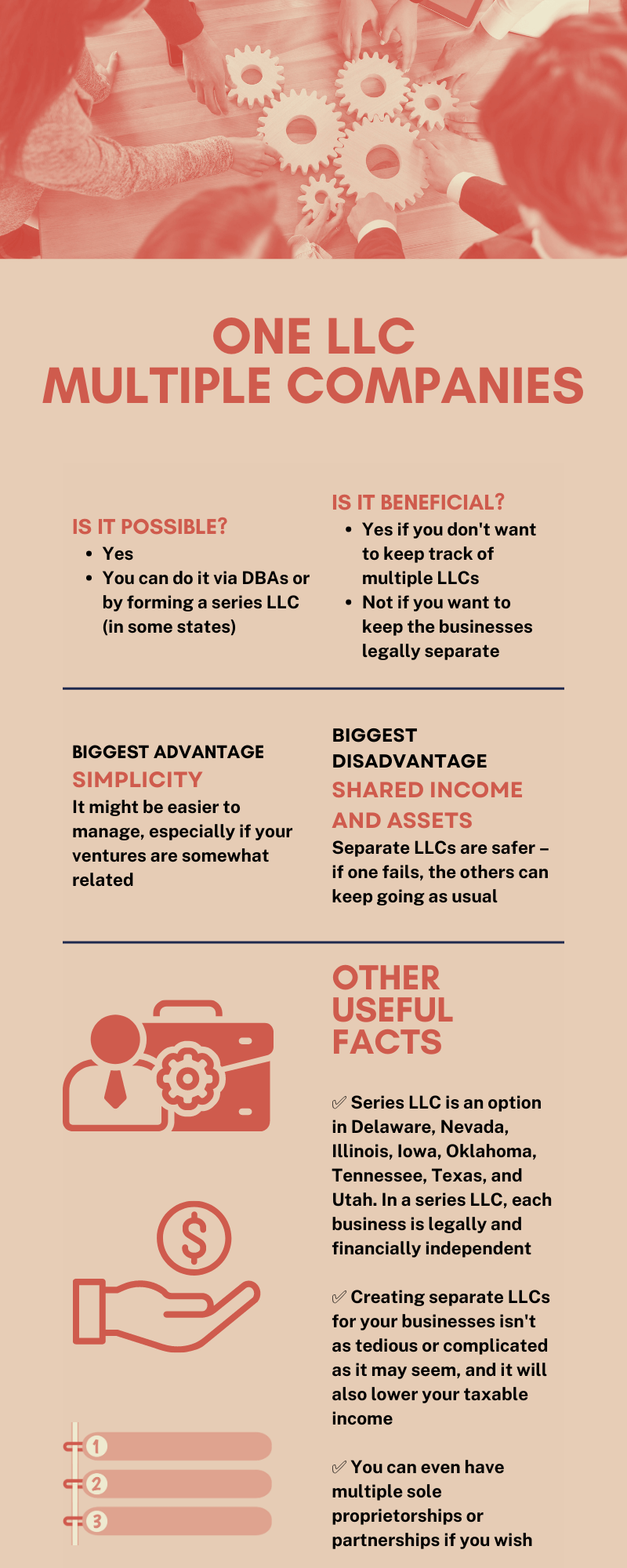

- Yes, you can have multiple businesses under one holding company or under your current LLC.

- Whether it’s a good idea or not depends on the risks each company may face.

- Multiple businesses under one LLC don’t have legally separate incomes or assets.

What Is a Single LLC?

LLC stands for Limited Liability Company, which is a business structure that offers personal liability protection to its owner. It can range in size from a single-member LLC to a large corporation.

Editor’s Note

One LLC can own another, so you could choose to set up another LLC owned by your current one. The assets of the two businesses would then not be distinct from one another, and any liabilities would also be pooled.

But some states (namely, Delaware, Nevada, Illinois, Iowa, Oklahoma, Tennessee, Texas and Utah) allow for a structure called a series LLC. If you go for it, each subsidiary LLC will be legally separate from the others. This means that debts and assets of one company would generally not affect the other subsidiaries.

Can I Have Multiple Businesses Under One LLC or Not?

Can I have multiple businesses under one LLC? The answer is yes! You can run multiple businesses under one holding company. In fact, there are many benefits to consolidating multiple businesses under a parent LLC – let’s discuss them.

Personal Liability Protection

Personal liability protection is one of the key advantages of an LLC, as we have explained. Your personal property, such as your home or car, won’t be in danger if your LLC is sued.

Tax Benefits

A second advantage of an LLC is the tax freedom it provides. You can decide whether you want to be taxed as a corporation, partnership, or sole proprietor, for instance.

Simplified Paperwork

Another advantage of having multiple businesses under one LLC is that it simplifies your paperwork. Instead of having to keep track of multiple tax returns and financial statements, you will only need to file one return for your LLC.

Increased Credibility

When you structure your businesses as a LLC, you may also find that it increases your credibility with customers and suppliers. You can still separate the businesses from each other in the view of the public via DBAs (doing business as).

Easier to Obtain Financing

Last but not least, you can discover that merging several firms under one LLC makes it simpler to get financing for your company. This is because lenders can more easily determine the financial risk of financing to you, as they will see your LLC as a single company.

What Are Some Other Options for Running Multiple Businesses?

Can I have multiple businesses under one LLC? Now you know the answer! But there are more options than operating multiple businesses under one single LLC holding company. You can consider the following.

Create Separate LLCs for Each Separate Business

You can create a separate LLC for each business you own. If you wish to keep each business separate for liability or tax reasons, this can be a viable solution. Yet, managing many individual LLCs may prove to be more expensive and complicated due to the need to keep track of each one separately.

Have Multiple Sole Proprietorships

Another option is to have a separate sole proprietorship for each business you own. In this case, all the businesses are owned and operated by you directly. This can be a simpler system than having multiple LLCs, as it generally requires less paperwork and compliance.

What About DBAs?

DBA is an acronym for “doing business as.” A DBA allows you to operate many businesses under a different name than your personal name or the legal name of your LLC. For example, if your LLC is named “Smith Enterprises, LLC,” you can file a DBA to do business as “Smith Cleaning Services.”

You can have multiple DBAs under one main LLC. This can be a good option if you want to operate different companies under different business names but don’t want to create an LLC for each new business.

Can I have multiple businesses under one LLC? Running one business venture can be difficult, but try running multiple businesses at the same time and understanding the concept of series LLC! Thanks for reading and good luck!

FAQ: Operating Two Businesses or More

How Do I Put Multiple Businesses Under One LLC?

To do this, you’ll need to set up a holding company – a new LLC that will hold the separate LLCs for each business. Holding companies are also known as umbrella companies or parent companies. Usually, their only role is to own the separate LLCs that are created to run each business venture.

Is It Better to Have Multiple Businesses Under One LLC?

It can be more or less beneficial, depending on your goals and business risks. Keep in mind that running two businesses under one LLC means that their incomes aren’t isolated from each other. If one business fails, the others are put at risk and all assets are subject to the debts of that business.

How Many Companies Can I Put Under My LLC?

There’s no legal limit, but the more companies you add, the more complex it can become to manage. You should also consider the risks associated with adding each business LLC and make sure that you keep track of their finances separately.

Can You Operate Multiple Businesses Under One EIN?

Yes, unless they’re separate legal entities. If the businesses are operated under one LLC, they can all use the same EIN. However, each business should be tracked separately in terms of income and expenses.

How Do You Name an LLC for Multiple Businesses?

You don’t need to come up with a name that will work for all your businesses. It’s easier for the parent company not to have any operations, while you run the real businesses under their respective names (DBAs).